4 Easy Facts About Eb5 Investment Immigration Described

Table of ContentsSome Known Facts About Eb5 Investment Immigration.What Does Eb5 Investment Immigration Do?The Single Strategy To Use For Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Do?Little Known Questions About Eb5 Investment Immigration.

Contiguity is established if census tracts share boundaries. To the level feasible, the combined census tracts for TEAs must be within one city location without more than 20 census tracts in a TEA. The consolidated census systems must be a consistent form and the address need to be centrally located.For more details about the program go to the U.S. Citizenship and Immigration Solutions internet site. Please permit one month to process your request. We usually react within 5-10 organization days of obtaining certification requests.

The U.S. government has actually taken actions focused on raising the degree of international financial investment for nearly a century. In the Migration Act of 1924, Congress presented the E-1 treaty investor course to aid facilitate profession by international sellers in the USA on a momentary basis. This program was broadened with the Immigration and Nationality Act (INA) of 1952, which developed the E-2 treaty capitalist course to additional attract international financial investment.

employees within 2 years of the immigrant financier's admission to the United States (or in particular scenarios, within an affordable time after the two-year period). In addition, USCIS may attribute financiers with preserving work in a distressed company, which is specified as a business that has remained in existence for at the very least two years and has actually suffered a bottom line during either the previous 12 months or 24 months before the top priority date on the immigrant investor's preliminary petition.

The Best Guide To Eb5 Investment Immigration

(TEA), which include certain assigned high-unemployment or country locations., which certifies their international capitalists for the reduced financial investment limit.

To certify for an EB-5 visa, a capitalist needs to: Invest or be in the process of spending at the very least $1.05 million in a new commercial enterprise in the United States or Spend or be in the procedure of investing at least $800,000 in a Targeted Work Location. One technique is by setting up the investment organization in a financially tested area. You may add a minimal industrial investment of $800,000 in a rural location with less than 20,000 in populace.

Eb5 Investment Immigration for Dummies

Regional Center financial investments permit the consideration of financial influence on the regional economy in the type of indirect work. Reasonable financial approaches can be used to develop enough indirect employment to satisfy the work creation demand. Not all local facilities are created equal. Any kind of capitalist considering look what i found attaching a Regional Facility must be extremely cautious to take into consideration the experience and success rate of the business before spending.

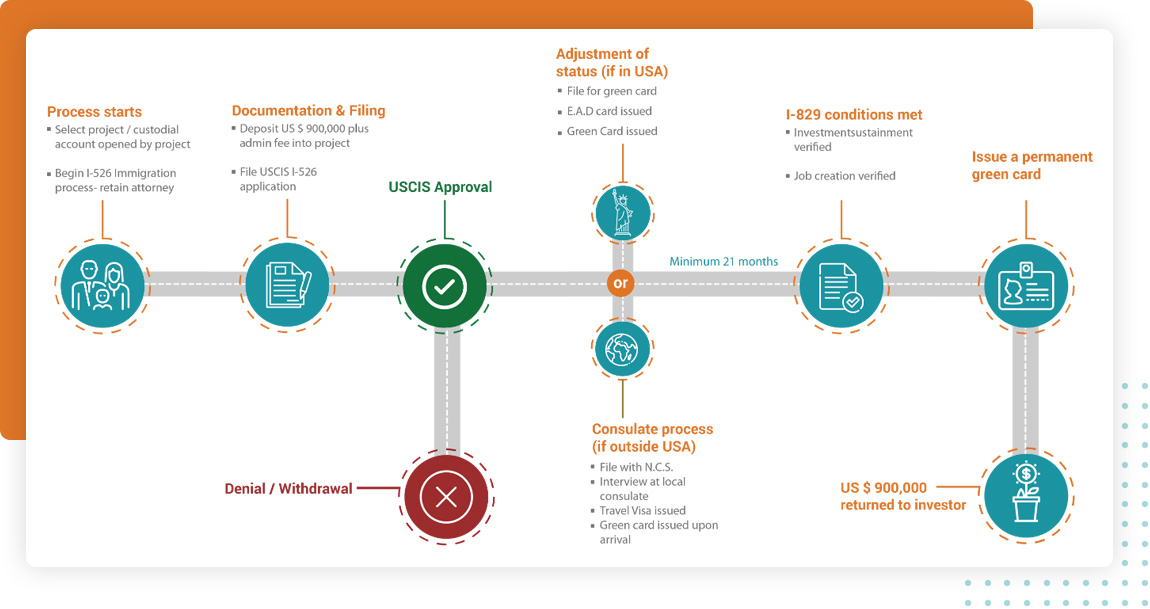

The financier initially needs to file an I-526 application with U.S. Citizenship and Migration Services (USCIS). This petition must consist of proof that the investment will produce permanent employment for a minimum of 10 united state people, permanent citizens, or various other immigrants that are authorized to work in the USA. After USCIS accepts the I-526 application, the investor may make an application for an environment-friendly card.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

If the financier is outside the United States, they will need to go via consular processing. Investor environment-friendly cards come with problems attached.

The brand-new section typically permits good-faith investors to retain their eligibility after discontinuation of their local facility or debarment of their NCE or JCE. After we inform financiers of the termination or debarment, they may preserve qualification either by alerting us that they proceed to satisfy eligibility needs regardless of the discontinuation or debarment, or by changing their petition to reveal that they fulfill the demands under section 203(b)( 5 )(M)(ii) of the INA (which has different needs depending on whether the financier is seeking to retain qualification due to the fact that their regional center was ended or since their NCE or JCE was debarred).

In all instances, we will make such resolutions constant with USCIS policy concerning submission to prior decisions to guarantee regular adjudication. After we terminate a local center's classification, we will withdraw any Type I-956F, Application for Approval of a Financial Investment in a Business, connected with the ended regional facility if the Form I-956F was authorized as of the date additional reading on the local center's discontinuation notification.

Everything about Eb5 Investment Immigration